grandriver/E+ through Getty Photos

Invesco S&P Worldwide developed the Momentum ETF (NYSEARCA: IDMO) makes use of a bullish technique utilized to shares in developed nations (ex-US and South Korea). The fund is exclusive in that, not like most different worldwide ETFs, it has delivered double-digit returns will bounce again this yr and even overtake the iShares Core S&P 500 ETF (IVV) for the primary 5 months by 1.84%.

Nonetheless, regardless of IDMO’s encouraging latest efficiency, I consider buyers ought to train warning when contemplating this car, because the long-term information suggests loads of danger and draw back. The principle drawback right here is that it didn’t sustain with the US market and likewise had a hardly comfy seize ratio. I want to spotlight these facets and counsel a have a look at the IDMO portfolio under within the notice.

Key factors of the IDMO technique

Since its inception in February 2012, IDMO raised $227.9 million. Contemplating all of the complexities of a world fairness portfolio, its expense ratio is kind of low at 25 foundation factors.

As we all know from his web site, the premise for his technique is the S&P World Ex-US Momentum Index. An essential notice right here is that the benchmark, previously S&P Momentum Developed ex-US & South Korea LargeMidCap Index, was renamed this Could. Nonetheless, the rebranding of the index was not helped by methodological adjustments, and it nonetheless excludes Korean shares.

I ought to clarify that there are variations out there classification of index suppliers. As I’ve mentioned prior to now, comparable to in a December 2020 article on the iShares MSCI World ETF (URTH), MSCI (MSCI) considers Korea to be an rising market in Asia Pacific. This has not modified since then, as proven by the outcomes of the MSCI 2024 Market Classification Evaluation introduced on 20 June. S&P Dow Jones Indices assigned Korea developed market standing in 2001. So in the case of this explicit index, plainly S&P DJI’s stance on Korean shares makes it extra much like the benchmarks supplied by MSCI.

To qualify for inclusion, a candidate should “have the best impulse rating.” From the prospectus, we all know that the mentioned rating is predicated on

the share change in share worth during the last 12 months, excluding the final month, and making use of the adjustment primarily based on the volatility of the safety over that interval.

Of the names that meet the necessities, the highest 20% with the very best scores are added to the index. The weighting scheme is predicated on modified market capitalization. As for rebalancing and restoration, IDMO’s web site says they happen “half-yearly on the third Friday of March and September”.

Earlier than we get into the dialogue of returns, it is essential to notice that as we all know from the publication, till March 18, 2016, the ETF tracked a high-beta index developed by S&P BMI Worldwide. Due to this fact, it is smart to disregard the efficiency achieved earlier than the technique change.

IDMO is again

Within the first 5 months of the yr, IDMO has carried out fairly strongly, outperforming IVV by 1.84%. However as a consequence of a sluggish June, pushed partly by a weaker Japanese yen because the distinction in U.S. and Japanese rates of interest weighed on dealer sentiment, it now not outperformed the S&P 500 ETF year-to-date. That is additionally the case with the iShares MSCI Intl Momentum Issue ETF (IMTM).

| ETF | Enchantment for January-June 2024 |

| IDMO | 13.61% |

| IMTM | 14.33% |

| EFF | 5.79% |

| IVV | 15.28% |

Knowledge from Visualizer Portfolio

Nonetheless, the iShares MSCI EAFE ETF ( EFA ), which has a heavy share of Japanese and UK shares, underperformed all of the funds talked about, returning simply 5.79%.

Though IDMO will now not outperform the S&P 500 ETF in 2024, its efficiency this yr is commendable. However right here it may be tempting to make use of short-term efficiency as a prerequisite for a thesis. That is unsuitable. IDMO is a technique primarily based on momentum and the returns that this issue offers are normally unstable. In the long run, it is all the time about discovering the very best time to purchase.

The issue is that once we zoom out, we see many flaws. As I discussed above, the draw back of the worldwide capital momentum technique consists of its long-term underperformance and hardly comfy most drawdown, with its publicity to the international trade market being a significant component. For affirmation, let’s take a look at the interval from April 2016 to June 2024.

| Metric | IDMO | EFF | IVV | IMTM |

| Begin steadiness | $10,000 | $10,000 | $10,000 | $10,000 |

| Ultimate steadiness | $20,865 | $17,627 | $30,675 | 19,161 {dollars} |

| CAGR | 9.32% | 7.11% | 14.55% | 8.20% |

| Customary deviation | 14.98% | 15.47% | 15.80% | 14.37% |

| The perfect yr | 29.18% | 25.10% | 31.25% | 25.46% |

| The worst yr | -16.64% | -14.35% | -18.16% | -16.80% |

| Most draft | -25.27% | -27.58% | -23.93% | -28.57% |

| Sharpe coefficient | 0.55 | 0.41 | 0.83 | 0.5 |

| Sartin issue | 0.83 | 0.6 | 1.28 | 0.73 |

| Upside Seize | 72.77% | 73.32% | 100.22% | 71.71% |

| Draw back Seize | 82.18% | 94.93% | 96.76% | 86.54% |

Knowledge from Visualizer Portfolio

Right here we see that IDMO has finished a stable job outperforming EFA-linked EFA shares and even its counterpart IMTM, which additionally favors momentum shares and ignores Korean shares (in response to MSCI’s market classification). So as to add extra brightness, it trailed the EFA solely in 2016 (April-December) and 2018. Nonetheless, in comparison with the IVV-proxied US market, IDMO seems to be a lot weaker as its annual return was a lot decrease and the utmost drawdown was deeper.

Due to this fact, it may be concluded that buyers who had been on the lookout for extra diversification within the technology-rich US market and due to this fact determined to enter the developed markets so as to enhance their returns and probably decrease a number of the headwinds within the international trade market, utilizing the issue momentum had been most likely dissatisfied IDMO.

What’s in IDMO’s portfolio in the meanwhile?

As of June 27, IDMO had 200 shares. 5 main holdings account for almost 25% of web property. Sure, this portfolio is kind of heavy.

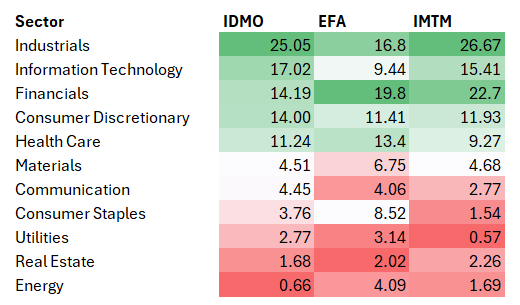

IDMO is considerably much like its IMTM counterpart in that each function manufacturing as the primary sector, not like EFA. Nonetheless, the Invesco ETF is considerably lighter in financials, whereas it’s chubby in client staples, utilities and client discretionary, to call a number of.

Knowledge in % (Generated utilizing ETF information)

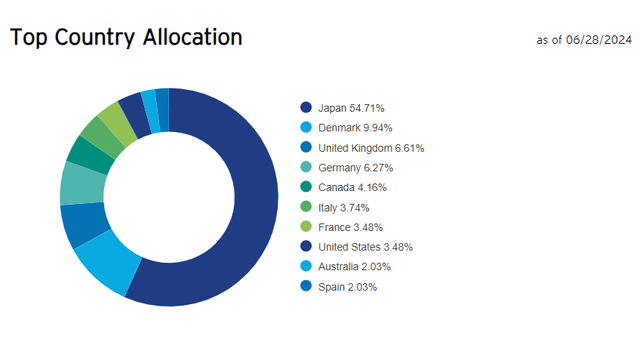

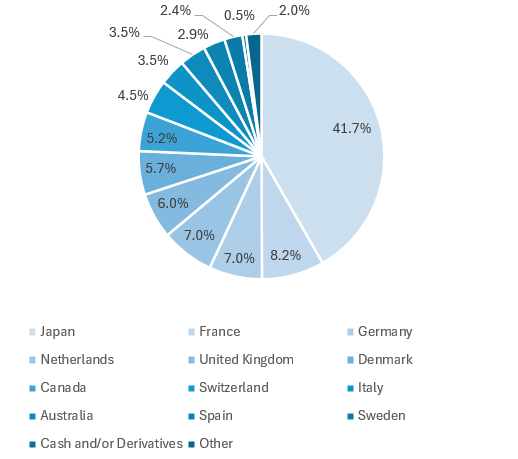

The ETF has a rustic combine that’s pretty customary for an ex-US developed markets technique. Nonetheless, the proportions are considerably distinctive as IDMO is kind of closely positioned in Japan, with the nation accounting for 54.7% of its portfolio. For context, regardless of this APAC nation being entrance and middle for a lot of worldwide portfolios, with EFA having 22.5% allotted to it and IMTM with 41.7%, IDMO has one of many largest exposures within the nation (excluding pure play in Japan). portfolio).

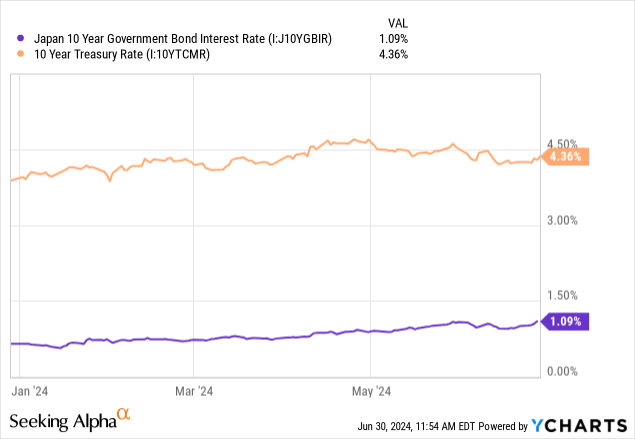

On this regard, it’s clear that IDMO carries much more yen danger than IMTM. It is true that the rise within the Nikkei 225 index (and thus the general rise in Tokyo) has contributed enormously to the ETF’s efficiency this yr. However the issue right here is that when the Japanese market is rising and the foreign money is depreciating (to be exact, to the extent of 1986), in greenback phrases the contribution seems to be a lot smaller.

In the hunt for Alpha

I’ve to say that the latest Could US PCE information might look in favor of a barely weaker USD and a barely stronger JPY because the outcomes justify a fast rate of interest reduce, however I’d chorus from being overly bullish. as rate of interest differentials stay fairly large and barely looser financial coverage within the US is probably not sufficient to considerably strengthen the ailing yen.

By way of main holdings, Novo Nordisk A/S (NVO) (Copenhagen ticker NOVO B) is vital within the combine with a 9.5% stake. Primarily as a consequence of NVOs, Denmark has a 9.9% weight within the IDMO portfolio. Nice Britain is in second place with 6.6%.

Make investments

That is in distinction to IMTM because it has much less publicity in Japan, with France and Germany in second and third place.

Created by the writer utilizing IMTM information

Beneath are IDMO’s high 5 holdings with a number of chosen metrics added.

| Adjusted ticker | inventory | Weight | Unique ticker | Market capitalization | Analysis class | Profitability class | Efficiency for the reason that starting of the yr |

| (NGO) | Novo Nordisk A/S | 9.5% | NOVOB DC | 640.5 billion {dollars} | F | A+ | 37.98% |

| (TM) | Toyota Motor Corp | 5.5% | 7203 JP | 275.46 billion {dollars} | B+ | A+ | 11.77% |

| (SAP) | SAP SE | 4.7% | SAP | 235.28 billion {dollars} | F | A+ | 30.48% |

| (OTCPK:HTHIY) | Hitachi Ltd | 2.7% | 6501 JP | 103.66 billion {dollars} | D- | A- | 55.76% |

| (OTCPK: TOELY) | Tokyo Electron Ltd | 2.4% | 8035 JP | 100.07 billion {dollars} | – | – | 23.26% |

Created utilizing information from Searching for Alpha and ETFs. Value efficiency is proven for US-listed securities (“adjusted ticker” column)

Conclusion

Total, IDMO is an fascinating choice for developed markets ex-US and ex-Korea. It has been greater this yr, even outperforming the S&P 500 ETF within the first 5 months, however that truth actually should not be used as the primary and solely premise for a bullish thesis. The principle drawback is that, like every other momentum technique, IDMO is essential to seek out the proper time to purchase it. For instance, it carried out stellar through the pandemic because it outperformed IVV in 2020. Additionally it is much less affected by the 2022 bear market. However over the long run, the technique has didn’t outperform the US market, largely as a result of IDMO’s strategy is unable to completely remove foreign money dangers. As well as, he has a excessive turnover charge of 131%. On this regard, the Maintain ranking seems to be nicely balanced.