The parcel supply large expects its income to rise sharply as 2024 rolls round

For KBS (KBS -3.06%) shareholders and potential traders, 2024 might be a story of two halves. Whereas the primary half of the yr is prone to present indicators of a decline in earnings, the second half guarantees a major upswing.

This potential for robust returns within the second half of the yr ought to make these two cohorts of traders optimistic about the way forward for UPS as a inventory.

In 2024, UPS is on a wild trip

Here’s a abstract of steering steering for your entire yr. Because the desk exhibits, it’s seemingly that the second half of the yr will see an enormous shift in revenue development in comparison with final yr. A number of components contribute to this transformation, and I’ll record the principle ones beneath.

UPS handbook | The primary half of 2024 | The second half of 2024 | Full yr 2024 |

|---|---|---|---|

earnings | Down 1% to 2% | As much as 4% to eight% | From 92 to 94.5 billion {dollars} |

Adjusted working earnings | Down 20% to 30% | 20% to 30% | From 9.2 to 10 billion {dollars} |

Information supply: UPS displays.

First, it is necessary to grasp why UPS had such a tough 2023. Briefly, the slowdown within the economic system resulted in lower-than-expected shipments. As well as, protracted labor negotiations and issues a few attainable strike have prompted some clients to divert quantity to different networks. The ultimate settlement (new contract) elevated labor prices, making it tough to cut back total prices at the same time as income fell.

Price comparability will turn into simpler

The excellent news is that the trucking firm will offset the fee will increase from the brand new contract within the second half of the yr, which can decrease the cost-to-income ratio. The chart beneath exhibits how earnings has modified (declined) yr over yr, however compensation and advantages haven’t modified.

Information supply: UPS displays.

This development is illustrated within the desk beneath, which shows compensation and advantages as a share of income. Compensation prices elevated markedly within the third quarter of 2023. Nevertheless, as soon as UPS begins to exceed these prices within the third quarter of 2024, the comparability might be way more favorable.

Information supply: UPS displays, chart by writer.

As well as, UPS introduced that it’ll minimize 12,000 jobs in 2024, which can save $1 billion. CEO Carol Thome and former CFO Brian Newman mentioned the difficulty throughout an earnings name in January. Newman famous that 75% of the job cuts will come within the first half of the yr, however the fee profit “might be weighed on the underside line.”

Thome added: “So now the fee is $1 billion, however we’ll have much more prices as we hit a full-year profit in 2025.” Thus, within the second half of 2024 and into 2025, UPS will expertise vital cost-cutting stress.

The amount of provides might be restored

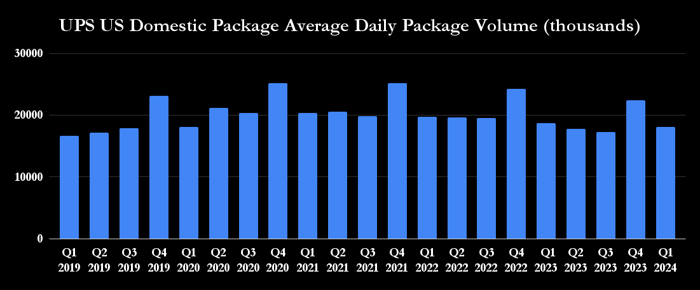

UPS administration can also be anticipating higher information on transport volumes within the second half of the yr, which can result in an anticipated 4-8% enhance in income in comparison with the second half of 2023. Development within the common each day quantity of home packages within the US could already be constructive timing writing.

Information supply: UPS displays.

For reference, the US home bundle fell 3.2% within the first quarter, however Thome famous that “the speed of decline slowed over the quarter, ending March at lower than 1%.” Newman went on to stipulate, “We anticipate Q2 to be barely constructive” when it comes to common each day quantity within the US home bundle section within the second quarter in comparison with final yr.

By the best way, this quantity is a key metric to observe when UPS releases its second quarter earnings report. Finally, Newman stated he expects the low-single-digit decline in U.S. home volumes within the first half to show into low-single-digit development within the second half.

UPS may have a greater half

Volumes enhance, earnings enhance, and value comparisons turn into simpler. These tailwinds reverse the headwinds the corporate confronted within the first half of the yr, and UPS will finish the yr a lot stronger than it began.

Moreover, in 2025 and past, administration’s concentrate on key finish markets corresponding to healthcare and small and medium companies (SMBs) ought to drive income development and margin growth, whereas investments in automation and sensible amenities ought to increase productiveness.

All of those constructive developments ought to start within the second half of the yr for UPS, and the corporate seems poised for a robust restoration — simply look ahead to administration’s feedback on quantity development within the second quarter earnings report.