If you do not have hours to commit to researching shares, ETFs are an incredible answer.

Between work, household, hobbies, and different commitments, most individuals do not have hours to commit to inventory market analysis. Additionally, let’s face it. Selecting particular person shares is extra sophisticated and dangerous than shopping for a basket of firms. This makes exchange-traded funds, or ETFs, a gorgeous automobile. ETFs commerce identical to shares, however the funds include dozens of shares associated to a selected theme. A number of ETFs cater to the market’s hottest sector: synthetic intelligence (AI).

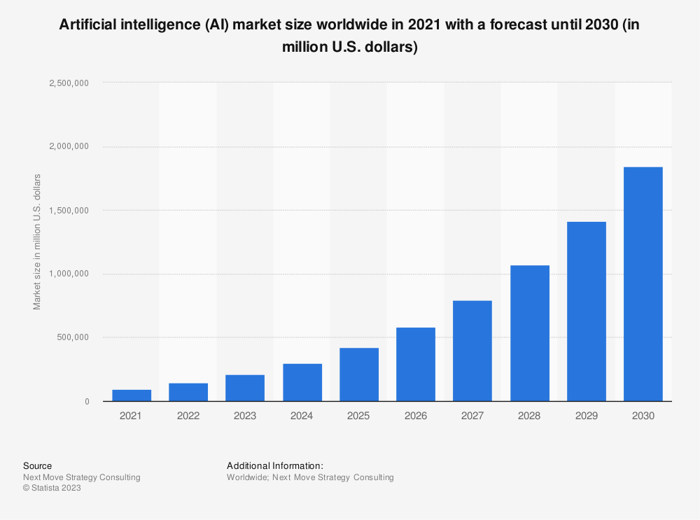

There may be a variety of hype round synthetic intelligence, and the passion is justified. Firms are spending billions of {dollars} researching real-world options and bringing them to market, and organizations in lots of industries are already integrating generative synthetic intelligence and enormous language fashions (LLM) into their workflows. The efficiencies these instruments present and our ultra-competitive enterprise world will encourage extra firms to undertake them.

The worldwide market dimension is estimated to strategy $2 trillion by the tip of this decade, as proven under.

Picture supply: Statista.

What are the most effective AI ETFs?

Not all ETFs are created equal. Components similar to diversification, belongings beneath administration, historic efficiency and expense ratio are vital. The World X Robotics & Synthetic Intelligence ETF (BOT 0.13%) is a well-liked synthetic intelligence fund. It has $2.8 billion in belongings beneath administration and an expense ratio of 0.68%, which is aggressive. It at present has 43 firms in its portfolio that target people who “will profit from the elevated adoption and use of robotics and synthetic intelligence.”

BOTZ is closely weighted to its main holdings. Nvidia (NASDAQ: NVDA ) makes up greater than 10% of the fund, and its prime 4 holdings make up greater than 35%. The fund was not accomplished SPDR S&P 500 ETF (NYSEMKT:SPY) over the previous 12 months, even supposing Nvidia gained 248%.

Along with the dependence on a couple of main holding firms, one other potential drawback is the absence of enormous expertise holding firms. BOTZ buyers are lacking out Alphabet (NASDAQ: GOOG)(NASDAQ: GOOGL ), Amazon (NASDAQ: AMZN ), Meta (NASDAQ), and Microsoft (NASDAQ: MSFT )and even one in every of my private favorites, Arm Holdings (NASDAQ: ARM).

BOTZ is greatest fitted to buyers on the lookout for a well-managed portfolio that incorporates a number of massive technology-focused shares.

World X additionally manages Synthetic intelligence and ETF expertise (AIQ -0.21%). AIQ has positions in 84 firms, has an expense ratio of 0.68% and has crushed the S&P 500 over the previous 12 months, as you’ll be able to see under.

SPY Complete Return Stage knowledge by YCharts

The Synthetic Intelligence & Expertise ETF has positions in all the above shares besides Arm Holdings. Its prime inventory can also be Nvidia, but it surely’s solely 5% of the entire. AIQ is greatest fitted to these on the lookout for a diversified portfolio with an emphasis on large tech. AIQ is a superb alternative with an amazing latest monitor document.

Right here is my favourite

Nonetheless, my favourite AI ETF is that this one WisdomTree Synthetic Intelligence and Innovation Fund (WTAI -1.11%). WTAI is the worst performing fund within the chart above, however that does not imply it will not do higher down the street. Nvidia and Microsoft account for almost 13% of the S&P 500 and eight% of the AIQ, however lower than 5% of the WTAI, which explains the underperformance. These shares exploded final 12 months, however they might quickly hit their truthful worth and break even.

The WisdomTree AI and Innovation Fund is probably the most diversified of the three funds I selected, with no firm accounting for greater than 3% of belongings. It at present has 75 shares, together with large tech names. It additionally has the bottom expense ratio at 0.45%. Its largest investments are in semiconductors (33%) and synthetic intelligence software program (24%), booming industries with robust progress alternatives as synthetic intelligence grows. The latest lows might change rapidly because the semiconductor business is cyclical and seems headed for a brand new progress cycle after a troublesome 2022 and 2023.

WTAI is a wonderful alternative for individuals who need vital diversification, a low expense ratio and entry to the most important names within the business.

You do not should be an excellent inventory picker to capitalize on a progress business like synthetic intelligence. Typically it’s higher to provide the selection to those that have extra time to observe the actions. ETFs provide broad publicity with much less threat and volatility. There are lots of choices; possibly one of many ones talked about above will give you the results you want.

Suzanne Frey, CEO of Alphabet, is a member of The Motley Idiot’s board of administrators. John Mackey, the previous CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Bradley Guichard holds positions at Alphabet, Amazon, Arm Holdings and Nvidia. The Motley Idiot has positions in and recommends Alphabet, Amazon, Microsoft and Nvidia. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and brief January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.