Genius Buddy/iStock by way of Getty Photographs

Funding perspective

Appian Company (NASDAQ: APPN) offers organizations with low-code enterprise course of automation software program.

I beforehand wrote about Appian in Could 2023 with a “Maintain” outlook as a result of slowing income development amid simpler price administration.

APPN nonetheless has an extended approach to go to breakeven, and earnings are rising at half their earlier development charge, so I stay impartial (maintain) on the inventory till administration can resume earnings development whereas making substantial progress towards breakeven.

Appian’s market and method

Appian markets low-code software program for a wide range of enterprise use instances.

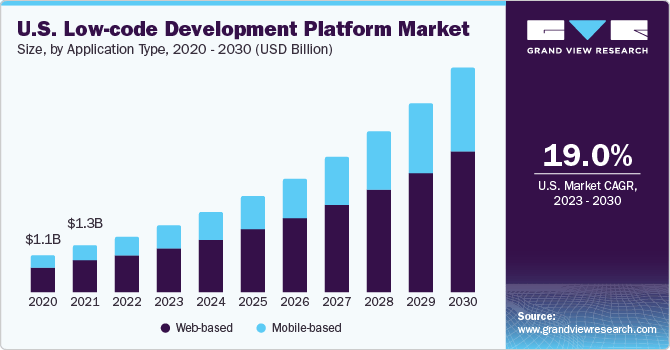

In accordance with a 2023 market analysis report by Grand View Analysis, the worldwide low-code growth platform market was valued at $6.8 billion in 2022 and is anticipated to exceed $35 billion by 2030.

If achieved, this development will characterize a really excessive compound annual development charge of almost 23% from 2023 to 2030.

The principle causes for this projected development are the rising demand for operational effectivity from corporations of all sizes and kinds and the will to scale back complexity to permit workers to give attention to higher-order duties.

Integrating synthetic intelligence or machine studying applied sciences can be a precedence for a lot of software program distributors.

The historic and projected future development trajectory of the US low-code growth platform market to 2030 is illustrated within the chart right here:

Grand View Analysis

Main rivals and different business gamers embrace:

Microsoft

Gross sales division

Auto programs

Mendix

Oracle

Google

ServiceNow

Fast base

Pegasystems.

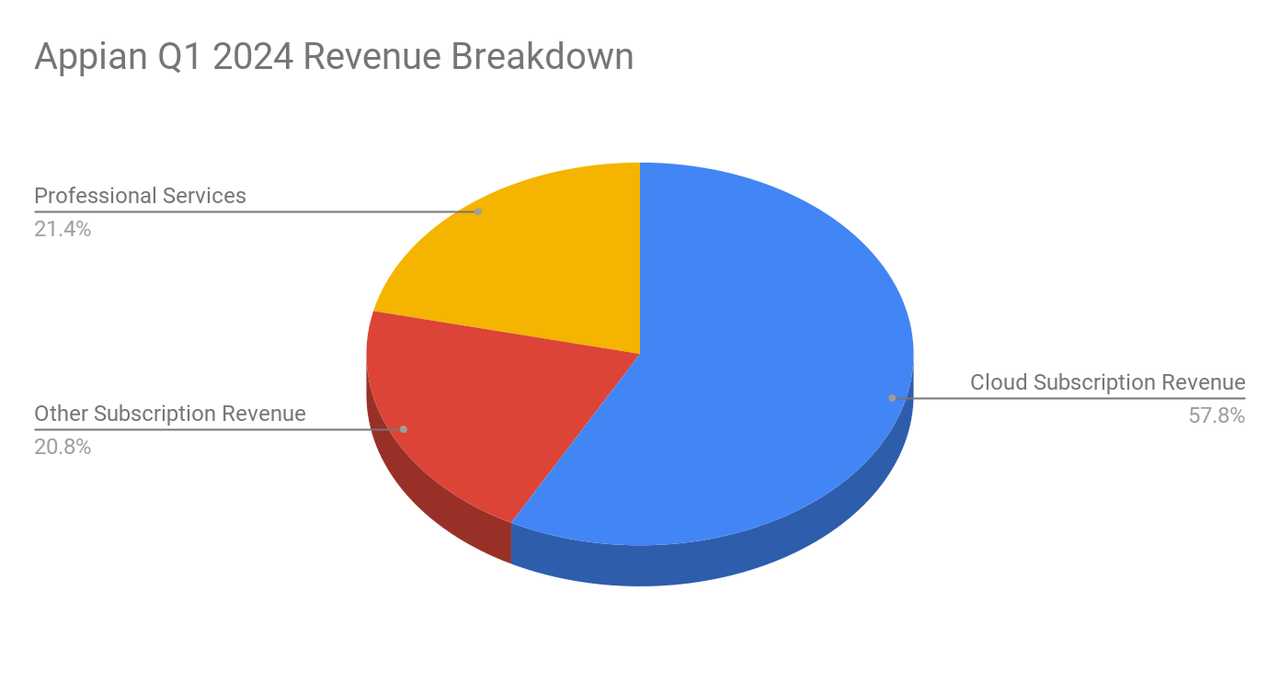

Appian’s income is damaged down into cloud subscription income, different subscription income, {and professional} companies, as proven right here in a pie chart with Q1 2024 outcomes:

Seeking Alpha

Appian’s gross sales mannequin is a typical “land and broaden” method, the place the agency seeks to ascertain a buyer base, carry out nicely, and broaden successfully throughout the buyer.

Cloud subscription income retention was 120% within the first quarter of 2024, larger than earlier quarters, so it is a optimistic signal and factors to an improved outlook and higher “land and growth” outcomes.

Current monetary developments

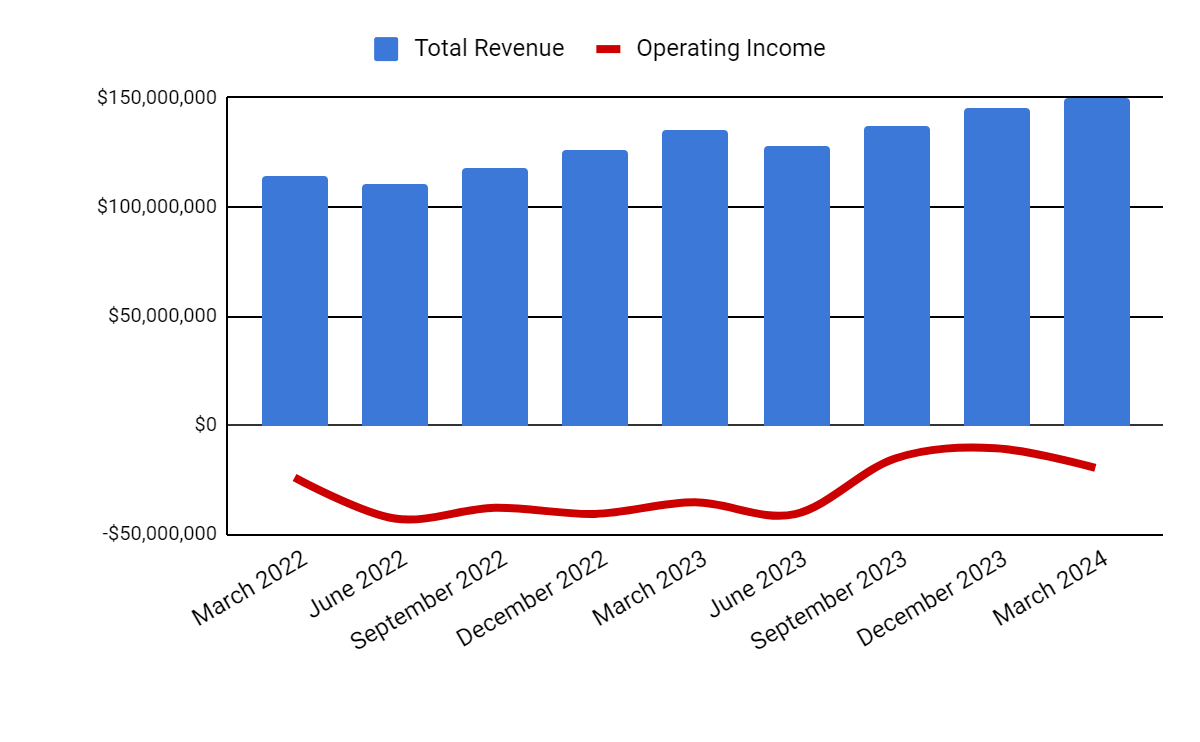

Whole income by quarter (columns) continued to develop at a average tempo regardless of macro uncertainty; Quarterly working earnings ( LINE ) declined as a result of barely larger complete and common bills.

Seeking an alpha

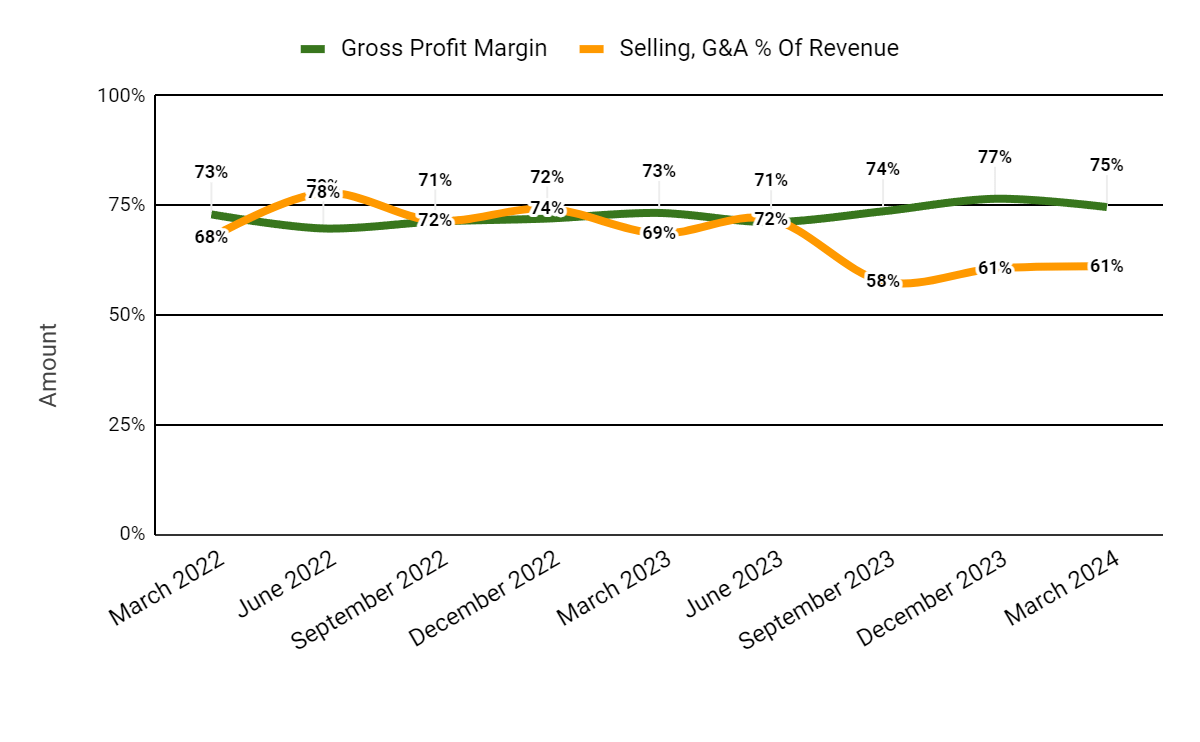

Gross revenue margin by quarter (inexperienced line) continues to rise, albeit inconsistently; Price of gross sales and complete bills as a proportion of complete income by quarter (orange line) stay decrease than final yr as a result of administration’s continued give attention to price administration.

Seeking Alpha

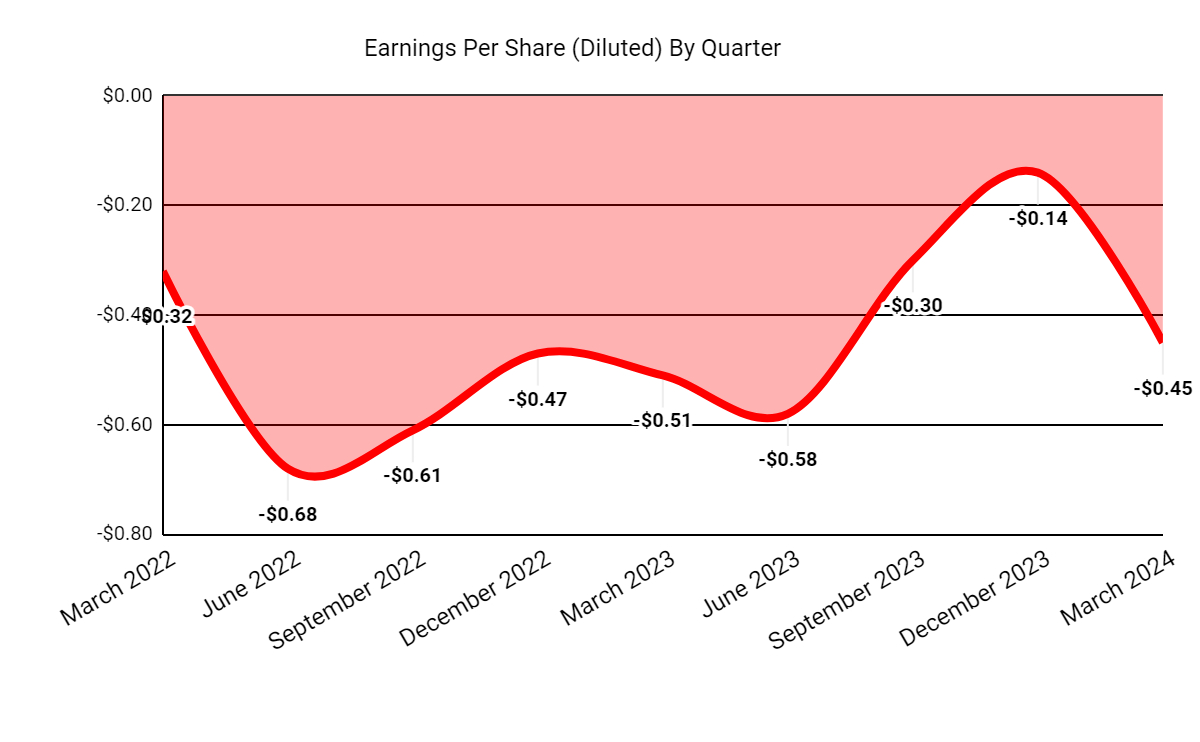

Earnings per share (diluted) remained materially unfavorable and deteriorated sequentially as a result of larger analysis and growth, curiosity and different non-operating bills, reminiscent of a international trade lack of $11.5 million because of the stronger US greenback.

Seeking Alpha

(All information within the above charts are GAAP.)

When it comes to stability sheet outcomes, APPN ended the quarter with $170 million in money and money equivalents and $255 million in complete debt, of which $7.1 million was due in lower than 12 months.

Within the trailing twelve months, free money used was ($73.7 million) and capital expenditures have been $7.4 million. The corporate paid out almost $43 million in stock-based compensation over the previous 4 quarters.

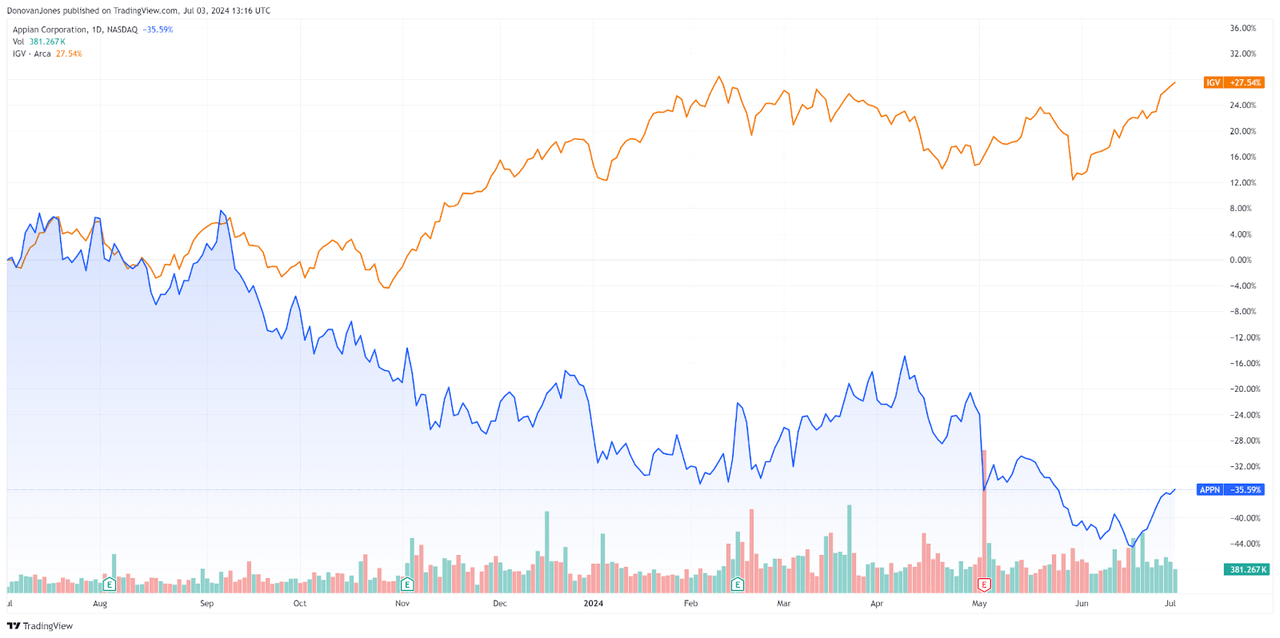

Up to now yr, APPN shares have fallen 35.6% in comparison with the iShares Expanded Know-how-Software program ETF’s ( IGV ) achieve of 27.5%, with the divergence beginning in September 2023, as proven within the chart right here.

TradingView

Beneath is a fundamental desk of monetary and operational metrics that gives useful numbers that I take advantage of to evaluate Appian’s efficiency and forecast estimates.

Metric | Sum |

EV/Gross sales (“FWD”) | 3.9 |

EV/EBITDA (“FWD”) | NM |

Worth/Gross sales (“TTM”) | 4.0 |

Income development (“y/y”) | 14.5% |

Internet revenue margin | -19.2% |

EBITDA margin | -13.7% |

Market capitalization | $2,220,000,000 |

The price of the enterprise | $2,380,000,000 |

Working money circulation | -$66,310,000 |

Earnings per share (totally diluted) | -1.47 {dollars} |

2024 FWD EPS Estimates | -0.80 {dollars} |

Estimated Reverse Progress (“FWD”) | 14.4% |

Free Money Circulate/Fairness (“TTM”) | -1.01 {dollars} |

Alpha quantitative rating search | Promote - 2.09 |

(Supply: Searching for Alpha.)

Appian’s Rule 40 efficiency, which provides to income and working margin development, remained weak and improved solely marginally, displaying a discount in unfavorable working margin on the expense of slower income development:

Rule 40 Efficiency (Unadjusted) | 1st quarter of 2023 | 1st quarter of 2024 |

Income Progress % | 26.7% | 14.5% |

Working margin | -29.4% | -13.0% |

In complete | -2.7% | 1.5% |

(Supply: Searching for Alpha.)

Why I’m impartial about Appian

Over a time period, Appian was in a position to scale back its working losses and set up a stable path to working break-even.

Administration made a aware resolution to give attention to price administration reasonably than “income development in any respect prices”, probably because of the larger price of capital, which punished loss-making corporations.

Whereas the corporate has made vital progress in slicing its working losses, income development has nearly halved in consequence, now anticipated to be round 14.4% in 2024, consistent with the trailing twelve-month determine.

That is an inexpensive development charge for a mid-sized agency that generates working earnings, however Appian could not come near breaking even on a GAAP foundation, besting This fall 2023, dropping $10.5 million on an working foundation.

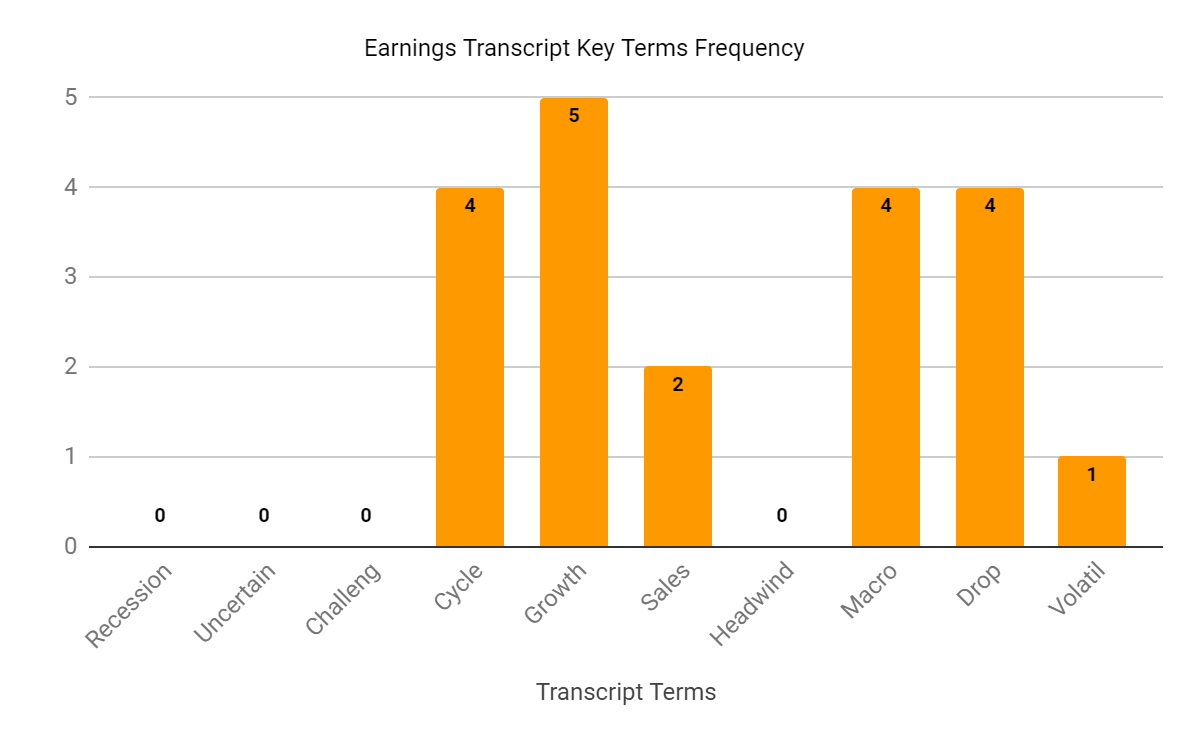

I monitor the sentiment on the newest administration and analyst convention name as an attention-grabbing have a look at the necessary elements. This chart reveals some key phrases:

Seeking Alpha

I’m most within the frequency of unfavorable phrases.

In Appian’s case, the corporate nonetheless feels uncertainty concerning the macroeconomic atmosphere and the affect of AI, though administration doesn’t see “massive AI budgets amongst [its] prospects, at the very least for now.

As such, administration sees the nascent AI area as a possible menace to its low-code platform enterprise.

When it comes to valuation, the market values APPN at an EV/Gross sales ratio of roughly 3.9x, with an estimated trailing twelve month income development charge of 12.9%, in comparison with the common Meritech SaaS Index implied ARR development charge of roughly 18% ( supply).

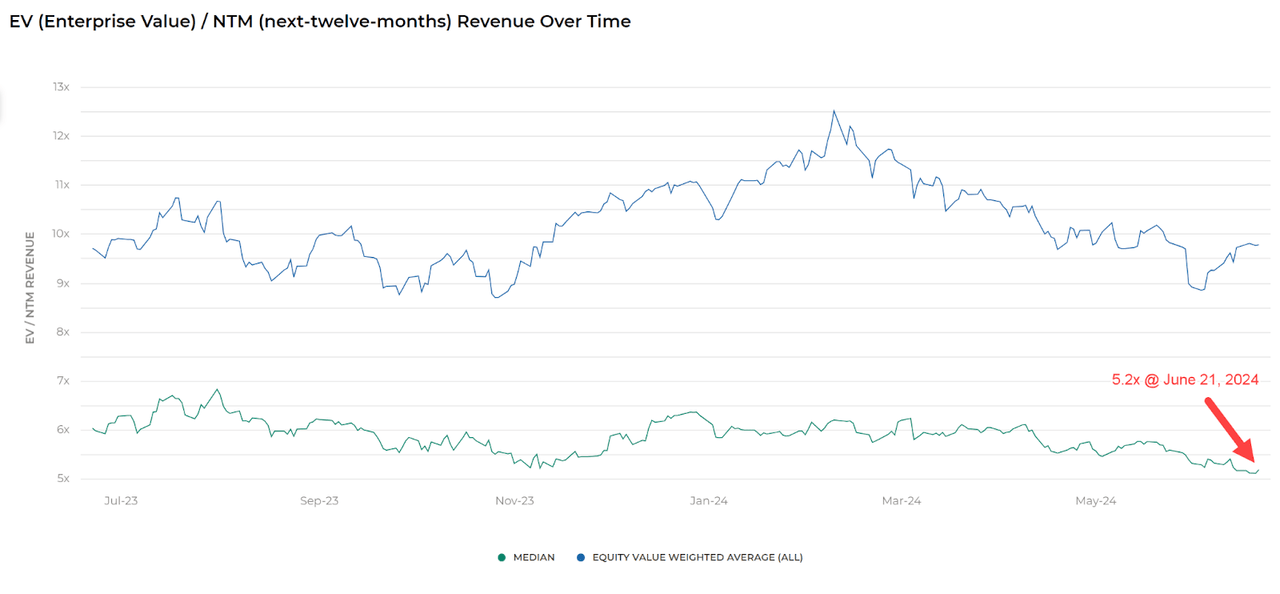

As of June 21, 2024, Meritech Capital’s index of publicly traded SaaS companies had a ahead EV/earnings a number of of roughly 5.2x, as proven within the chart under:

Meritech Capital

So, compared, APPN is at present valued by the market at a reduction to the broader Meritech Capital SaaS Index as of June 21, 2024.

That is probably due partially to the anticipated slowdown in income development in 2024.

Like many expertise software program corporations in current instances, the corporate has did not ship vital development together with working revenue, so its valuation within the public markets has suffered.

The Searching for Alpha chart under reveals a 43% drop in EV/Gross sales previously yr alone:

Seeking Alpha

Whereas I count on the discount in price of capital assumptions to be a optimistic catalyst for the inventory’s valuation a number of, this will take an extended time period.

In the meantime, I stay impartial (maintain) on APPN as a result of lackluster fundamentals, a pause on the trail to break-even, and a good valuation at present ranges of modest earnings development.