On-chain information reveals that lively Bitcoin addresses have modified not too long ago, which could possibly be constructive for the worth of the cryptocurrency.

Every day lively Bitcoin addresses have been on the rise not too long ago

In response to information from the market analytics platform IntoTheBlock, Bitcoin has not too long ago seen a rise in day by day lively addresses. An “lively tackle” participates in some transactional exercise on the blockchain.

The Every day Energetic Addresses metric tracks the distinctive whole variety of such addresses that grow to be lively each day. The indicator naturally takes into consideration each senders and receivers.

As the worth of this indicator will increase, extra addresses are transferring on the community. Since distinctive addresses might be seen as distinctive customers on the chain, this development implies that the cryptocurrency receives extra site visitors.

However, a lower within the indicator signifies that the blockchain is changing into much less lively, which is a doable signal that buyers are dropping curiosity within the asset.

Here’s a chart exhibiting the development of day by day lively bitcoin addresses over the previous few months:

Seems to be like the worth of the metric has been going up in latest days | Supply: IntoTheBlock on X

As you’ll be able to see within the chart above, day by day lively bitcoin addresses have seen a pointy rise in latest instances, and at their peak, their worth surpassed the 900,000 mark.

Because of this over 900,000 addresses have transacted inside 24 hours. “This spike is a part of a broader development as exercise has been slowly choosing up since early June,” the analyst agency famous.

Previous to this latest uptrend, the indicator fell as customers started to pay much less consideration to the coin. Nonetheless, with this improve, the variety of day by day lively addresses has recovered to the extent of mid-April.

Traditionally, rallies have been extra sustainable when there was fixed gasoline within the type of extra customers. Due to this fact, a rise within the variety of day by day lively addresses may pave the best way for Bitcoin value spikes to start.

So, it stays to be seen whether or not this newest burst of exercise will even be the idea for the cryptocurrency to supply a brand new bullish momentum.

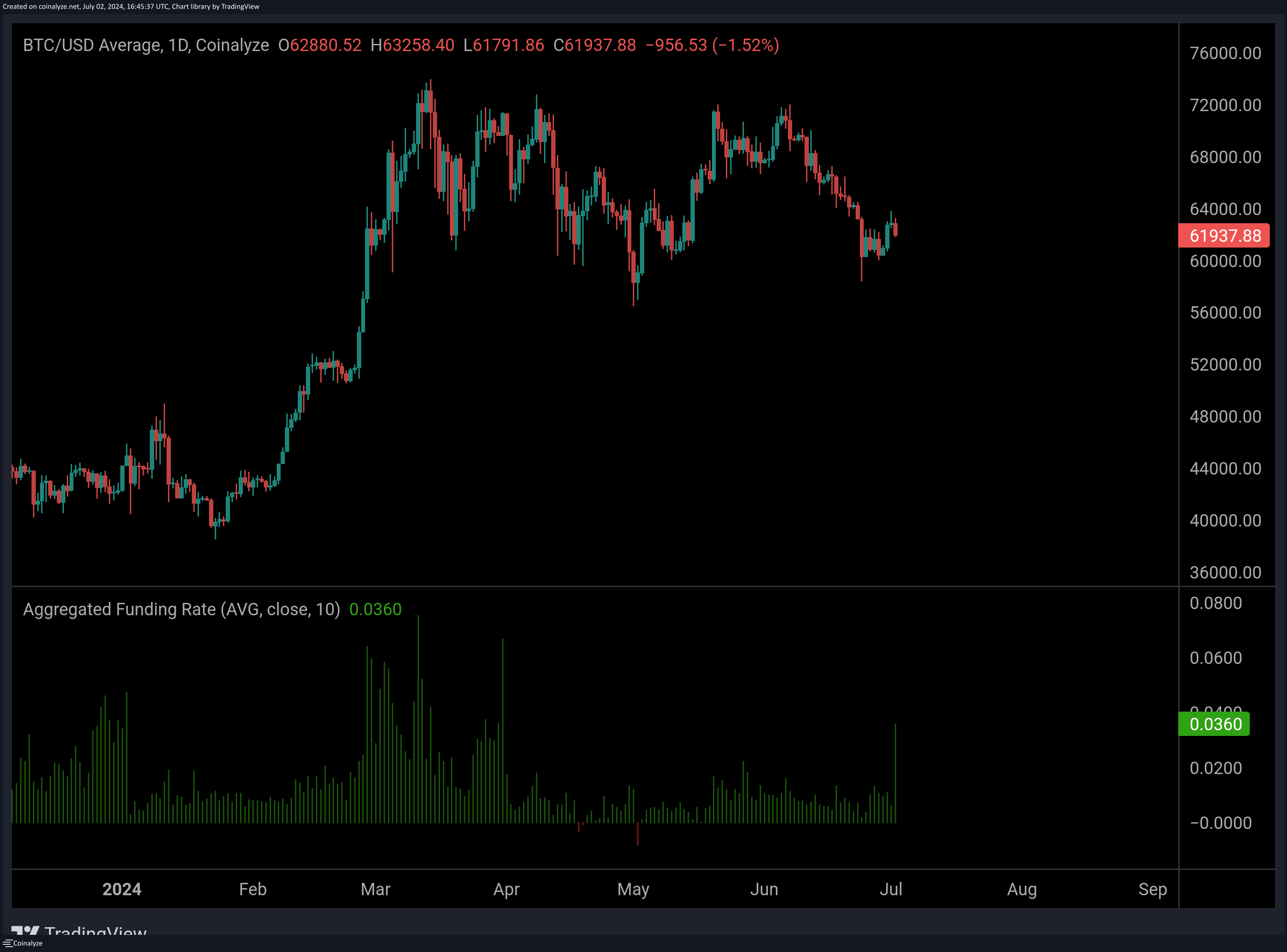

In different information articles, bullish bids are on the rise within the Bitcoin derivatives market, as famous by CryptoQuant neighborhood supervisor Maartun in a submit by X.

The information for the BTC funding charges over the previous few months | Supply: JA_Maartun on X

As proven within the chart, the funding fee in Bitcoin has elevated not too long ago, indicating that holders of lengthy contracts are considerably outnumbering holders of quick contracts. Traditionally, this dominance of bullish sentiment has not been a constructive signal for the worth of a cryptocurrency.

BTC value

On the time of writing, Bitcoin is hovering round $61,900, down greater than 2% within the final 24 hours.

The worth of the coin appears to have been consolidating not too long ago | Supply: BTCUSD on TradingView

Picture from Dall-E, IntoTheBlock.com, chart from TradingView.com