The info exhibits that Bitcoin Web Taker Quantity has been largely destructive just lately. This is what it might imply for the asset’s worth.

Web Taker’s Bitcoin quantity has been largely destructive over the previous month

As CryptoQuant Group Supervisor Maartun famous in a submit on X, the Web Taker Quantity signifies a scarcity of serious taker shopping for up to now month.

“Web Quantity of Takers” is an indicator that tracks the distinction between shopping for and promoting volumes of Bitcoin. Naturally, the 2 volumes measure purchase and promote orders executed by contributors in perpetual swaps.

If the worth of this indicator is constructive, it signifies that the amount of shopping for is taking greater than the amount of promoting is taking. This development implies a bullish temper for many market shares.

Then again, an indicator beneath the zero mark signifies dominance within the bearish sector, as quick quantity exceeds lengthy quantity.

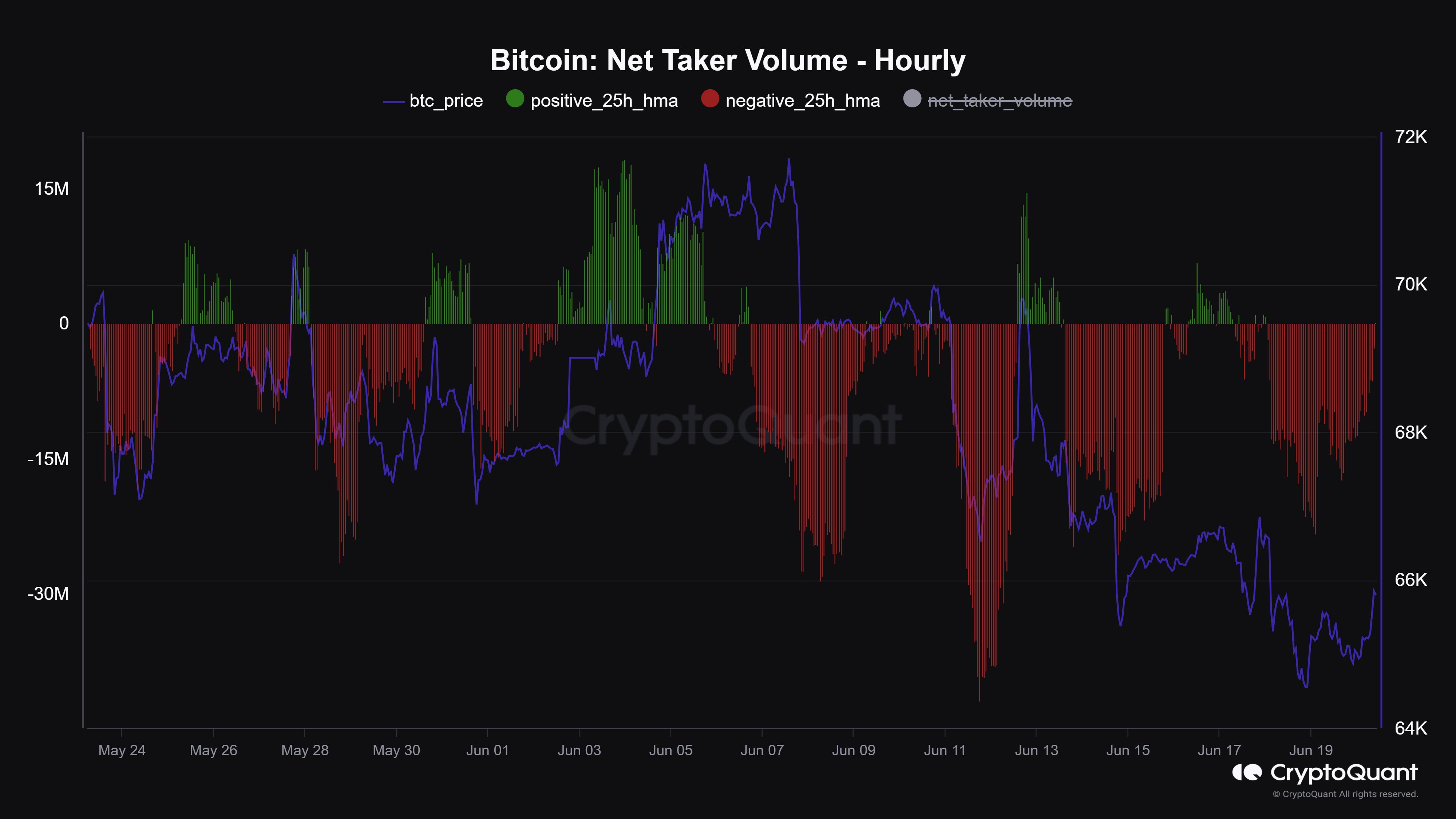

Here’s a chart displaying the development in Bitcoin Web Taker quantity over the previous month:

The worth of the metric seems to have been destructive in latest days | Supply: @JA_Maartun on X

As proven within the chart above, Bitcoin NetBrowser quantity recorded only some spikes into constructive territory throughout this window, and the dimensions of these spikes was not too massive both.

All the remainder of the time the indicator was within the crimson space, typically observing considerably destructive values. So, it seems that the amount of gross sales that takers dominated the market final month.

The graph exhibits that one stage throughout this era, when constructive values reached a noticeable scale, was accompanied by a rise within the worth of the cryptocurrency. So the metric might have to flip again to inexperienced if BTC has to get better a bit.

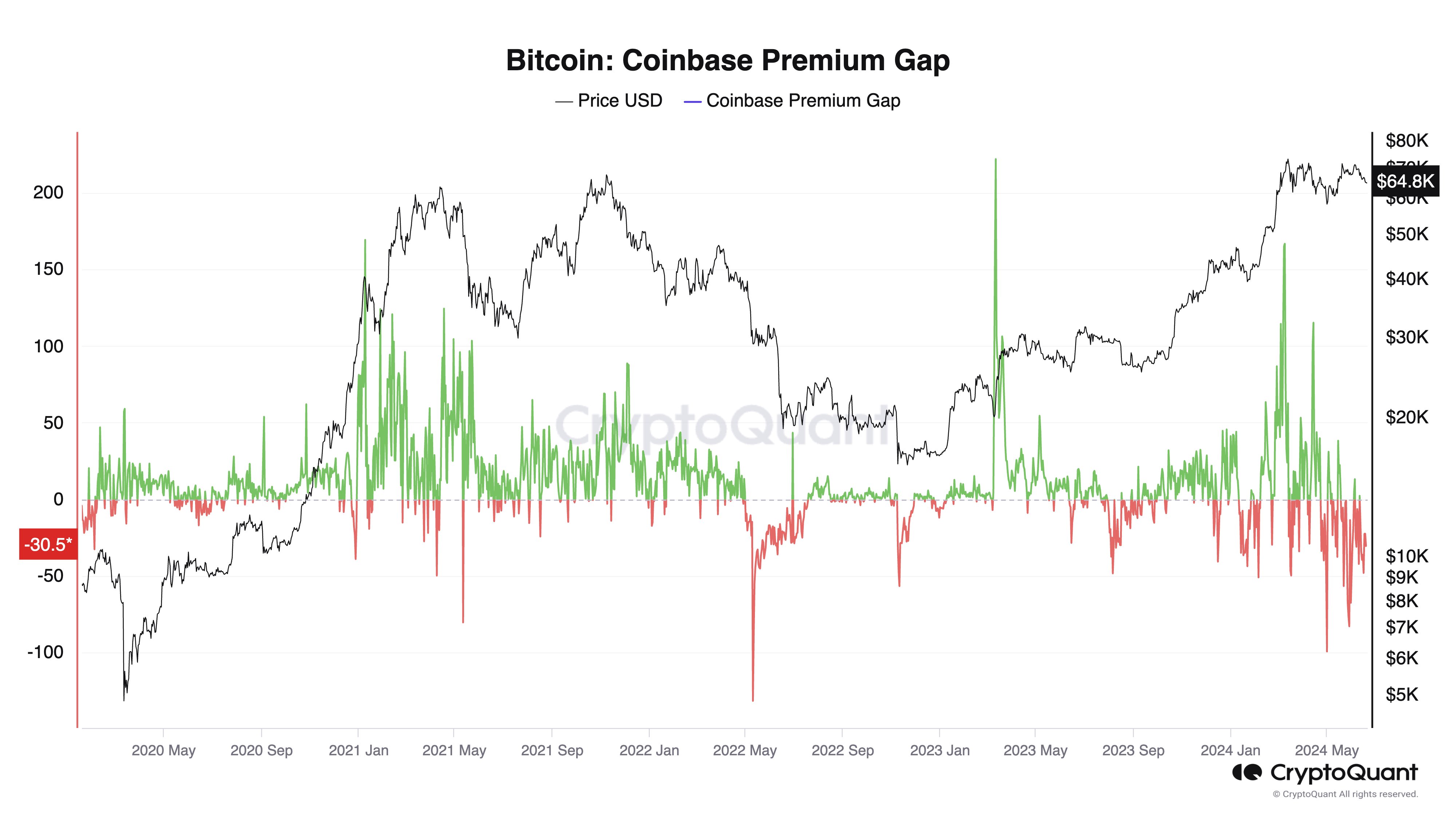

Netshore quantity hasn’t been the one metric that is been bearish for Bitcoin these days; it seems that Coinbase’s premium hole was additionally destructive, as CryptoQuant founder and CEO Ki Younger Joo shared in an X submit.

Appears to be like like the worth of the metric has been fairly crimson in latest weeks | Supply: @ki_young_ju on X

The Coinbase Premium Hole tracks the distinction between the costs of Bitcoins quoted on the Coinbase (USD pair) and Binance (USDT pair) cryptocurrency exchanges. The worth of the indicator displays how investor conduct on Coinbase differs from that on Binance.

Because the chart exhibits, Bitcoin Coinbase Premium Hole has just lately been in underwater territory, indicating that Coinbase is experiencing extra promoting strain than Binance. This sale could also be one of many the explanation why the asset has been caught within the consolidation course of these days.

BTC worth

Bitcoin is buying and selling round $64,800, which is in a variety the place the asset has been transferring sideways for a while.

The value of the asset appears to have been happening just lately | Supply: BTCUSD on TradingView

Featured picture from Dall-E, CryptoQuant.com, chart from TradingView.com