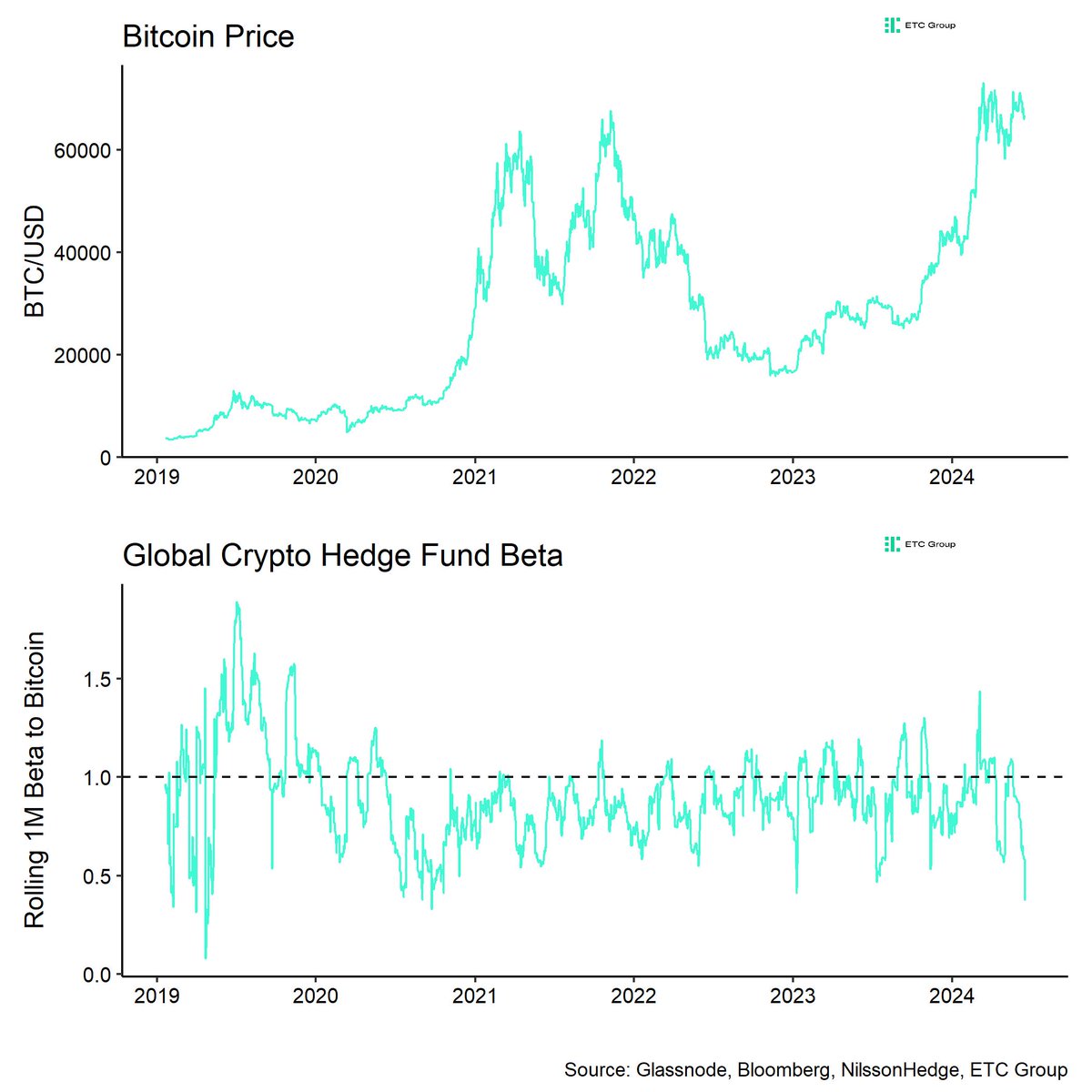

The crypto panorama has seen a notable shift in hedge fund methods, with publicity to Bitcoin at its lowest degree since October 2020.

Specifically, ETC Group’s newest analysis highlights a major discount in these funds’ bitcoin holdings, signifying a strategic shift that might have broader implications for the cryptocurrency market.

Throw within the towel for Bitcoin

Andre Dragoš, head of analysis at ETC Group, notes that crypto hedge funds have drastically lowered their publicity to BTC. Over the previous 20 buying and selling days, publicity has fallen to only 0.37, the bottom since October 2020, Dragos stated.

This decline displays a cautious or bearish sentiment within the skilled funding group in direction of Bitcoin amid the asset’s ongoing wrestle to rally.

This cautious method by hedge funds coincides with a protracted exodus from crypto-exchange merchandise, signaling a broader pattern of declining confidence amongst institutional buyers.

Dragoš additionally famous that hedge funds usually exhibit pro-cyclical conduct – in search of to take a position in step with market tendencies – which might imply a sluggish return to Bitcoin within the occasion of a market rally.

BOOM: Crypto hedge funds have actually given up on it #Bitcoin these days.

They lowered them $BTC the market publicity is just 0.37 within the final 20 buying and selling days.

The bottom price since October 2020. pic.twitter.com/WZCRK9QlMG

— Andre Dragoš | Bitcoin and Macro

(@Andre_Dragosch) June 19, 2024

Bitcoin’s resilience to headwinds

BTC, however, is exhibiting indicators of resilience, cozying as much as the $66k mark earlier earlier than falling barely to $65,142 on the time of writing, although nonetheless sustaining a modest day by day acquire of 0.4%.

The broader market downturn and a number of other key elements are driving this exercise. Analysts at CryptoQuant have recognized the capitulation of miners, the shortage of latest stablecoin releases, and a major outflow of ETFs as the principle elements behind the latest market decline.

Specifically, the decline in miner revenue has elevated BTC gross sales to cowl working prices, growing downward stress on costs.

On the identical time, the slowdown in main stablecoins equivalent to USDT and USDC has lowered the circulate of latest cash into the market, affecting liquidity and growing volatility.

The background to this dynamic contains speculative actions such because the German authorities allegedly the sale of BTC holdings which added to the thrill of the market.

The German authorities is now on Arkham.

Germany’s Federal Prison Police Workplace (BKA) has seized almost 50,000 BTC ($2.12 billion) from the operators of https://t.co/ck07DiJUAf, a film piracy web site that operated in 2013.

BKA acquired the bitcoins in mid-January after a “voluntary… pic.twitter.com/0kC5tOPq6e

— Arkham (@ArkhamIntel) January 31, 2024

Regardless ofthis stress, the CryptoQuant analyst exhibits good upside, with present worth ranges near vital assist zones which have traditionally provided sturdy rebound potential.

Featured picture created with DALL-E, chart from TradingView

(@Andre_Dragosch)

(@Andre_Dragosch)