- The value of Bitcoin is down nearly 7% within the final week, with the bulls unable to carry above the $70,000 stage. BTC fell to round $66,350 in the present day amid renewed promoting stress.

- Whereas costs are falling because the market reacts to macroeconomic occasions, CryptoQuant analysts say among the draw back is as a result of promoting stress miners are going through.

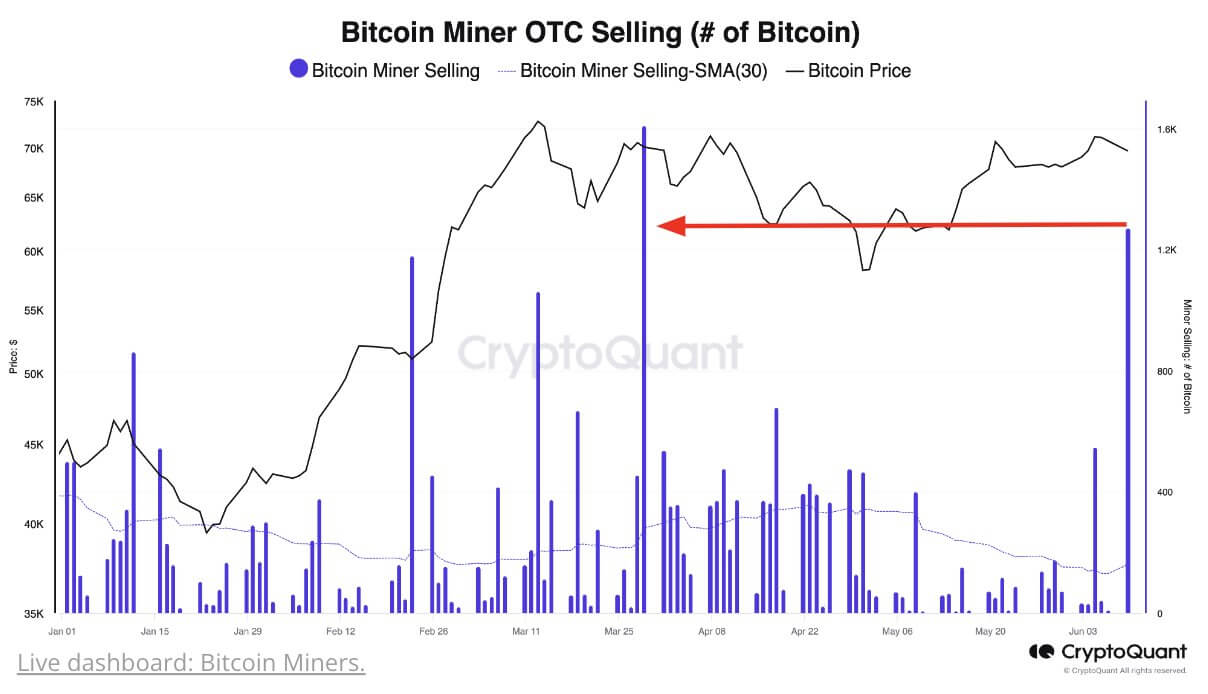

In response to CryptoQuant’s Thursday replace, there was a surge in mining pool transfers and BTC OTC gross sales. Some massive public bitcoin mining firms have additionally not too long ago diminished their holdings.

“BTC miners elevated gross sales when costs ranged from $69,000 to $71,000. On June 9, transfers from mining swimming pools to Binance skyrocketed, reaching a 2-month peak of over 3,000 BTC. This shift coincides with a value correction that introduced Bitcoin right down to $66k,” the CryptoQuant crew famous in a put up on X

The information additionally reveals a rise in OTC gross sales, with the most recent being an OTC sale of 1,200 BTC on June 10.

In the meantime, main US bitcoin mining firms have bought off cash – for instance, Marathon Digital (MARA) unloaded 1,400 BTC in June. The corporate bought solely 390 in Could.

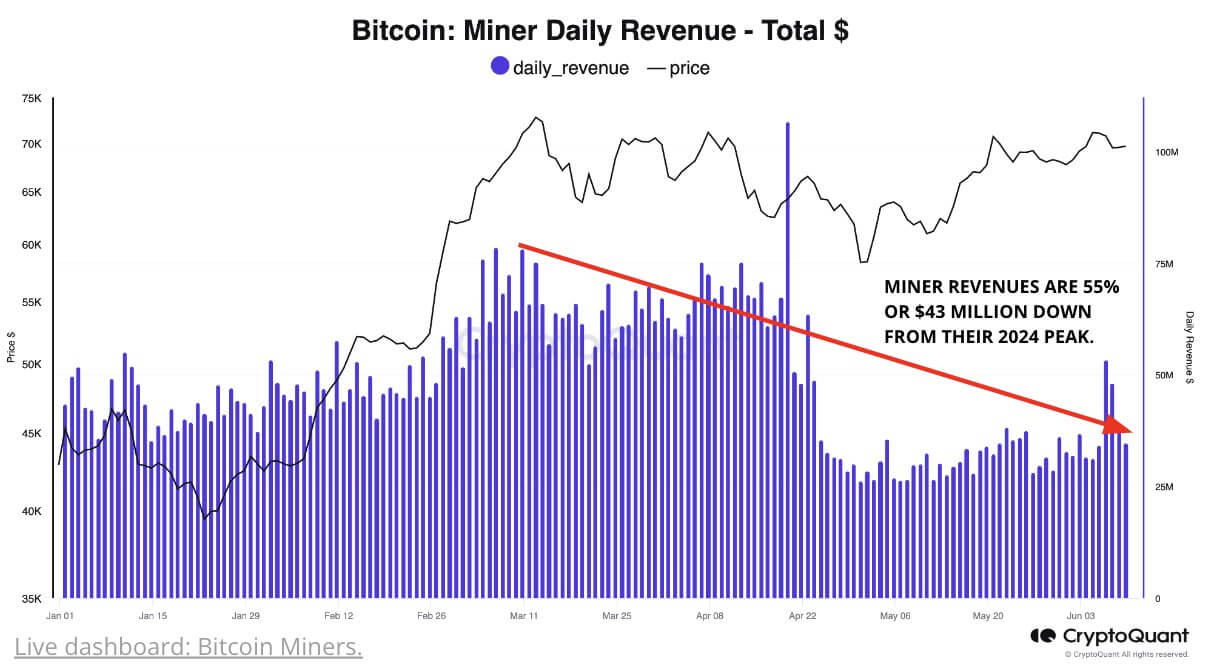

Miner’s earnings dropped by 55%

Miner promoting stress intensified as mining revenues fell.

For instance, the miner’s each day earnings after the halving reached $35 million. This peaked at $78 million in March, representing a pointy 55% decline.

“Amidst low miner earnings after the doubling, the each day bitcoin transaction charge has dropped to round 65 bitcoins from 117 till April 18. Regardless of report excessive transactions, common USD transaction charges stay low, highlighting the stress on Miner revenues,” the CryptoQuant crew famous.

Analysts additionally say that the Bitcoin community additionally noticed a drop in hashrate after the halving, however solely by 4%.

This implies miners are going through stiff competitors amid diminished block rewards and the mix of low miner earnings and excessive hashrate “usually level to potential market lows.”

“Miners have skilled vital underpayments since Could, suggesting we could also be near a value backside,”