Constancy’s Director of World Macro, Jurien Zimmer, just lately commented on the talk over whether or not Bitcoin or gold is a safer retailer of worth, outlining eventualities of when every of those asset courses is ready or unable to hedge in opposition to inflation relying on the financial atmosphere. .

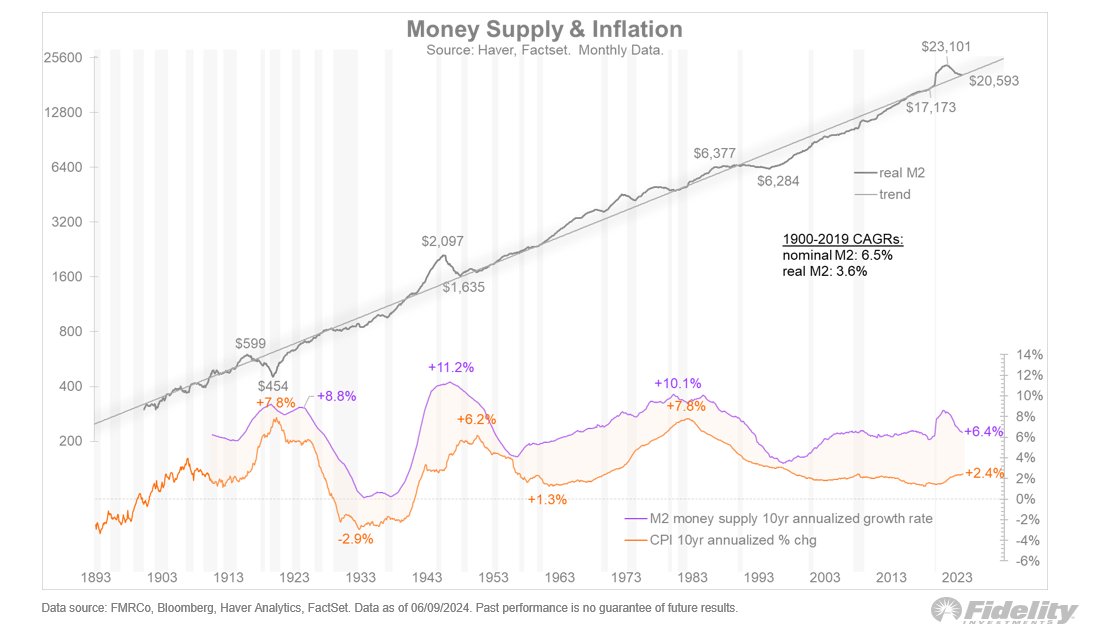

Concept of cash provide and asset valuation

Zimmer’s reasoning relies on the idea of “fiscal dominance,” the place a authorities seeks to extend the cash provide by threatening the buying energy of a forex. It notes inflation, which is confirmed by the historic dependence of the cash provide M2/CPI.

And whereas BTC and gold are arguably probably the most inflation-resistant belongings based mostly on this idea, Zimmer believes that such an atmosphere has but to totally materialize, even after the current hawkish motion by the Federal Reserve.

As well as, on account of its volatility, Bitcoin can also be known as “digital gold”, “gold 2.0” and “exponential gold”, as a result of on the one hand, Bitcoin has all of the financial components that gold has. Nevertheless, in line with Zimmer, it’s also a brand new Web expertise.

Nevertheless, for bitcoin to enter and preserve its place with gold, notional financial aggregates should proceed to develop by an quantity that exceeds regular tendencies.

Whereas there was a surge within the M2 cash provide in the course of the current pandemic, the tightening of financial coverage by the Federal Reserve made it short-lived, in line with Zimmer. This means that gold and bitcoin could also be prematurely fulfilling their position as absolute shops of worth.

At the moment, the value of Bitcoin has risen to $69,523 following the most recent CPI report, which indicated a slowdown in inflation, which may sign a strengthening of its place as a retailer of worth.

This report additionally had a constructive impression on the value of gold, because the asset was in a position to acquire 0.91% within the final 24 hours at a present buying and selling value of $2,336.

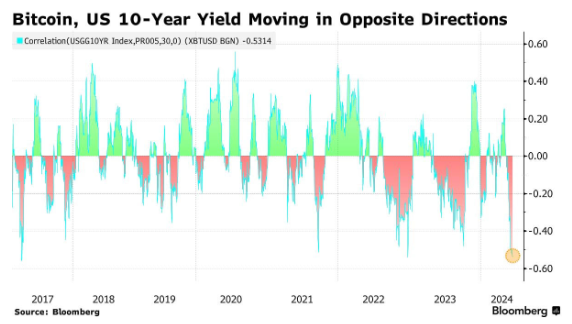

Influence of Treasury Yield Correlation on Bitcoin

In the meantime, the value of Bitcoin (BTC) misplaced its correlation with the 10-year US Treasury (UST) yield because the correlation fell to a 14-year low of 53, in line with the most recent knowledge supplied by Barchart.

The cut up implies that BTC is now creating by itself, with out the market impression of standard fiscal devices, such because the yield on Treasury bonds S. This indicator determines the return of traders in authorities securities.

This might point out that Bitcoin is extra loosely tied to conventional monetary methods, which could possibly be the start of its evolution into a part of its personal distinctive asset class.

If Bitcoin continues to diverge from these conventional monetary metrics, it may considerably enhance its case for being the perfect non-traditional hedge in opposition to monetary volatility.

Nevertheless, the overall limitations of bitcoin and gold as shops of worth, Zimmer acknowledges, are based mostly on financial circumstances that haven’t but occurred, notably by way of cash provide and inflation.

Featured picture created with DALL-E, chart from TradingView